UTI Asset Management Company Limited-UTI AMC Mutual Fund, History & Share Price

UTI AMC is a moderately high-risk fund with a 17.7 percent CAGR/Annualized return since inception. In the Mid Cap category, it is ranked 36.

Mid-Cap UTI Fund-Introduction: It is a moderately high-risk fund with a 17.7 percent CAGR/Annualized return since inception. In the mid-cap category, it is ranked 36. The return for 2021 was 43.1 percent, 32.7 percent in 2020, and -0.2 percent in 2019.

The government owns 74% of the company through four public sector institutions: Life Insurance Corporation of India (LIC), State Bank of India (SBI), Punjab National Bank (PNB), and Bank of Baroda (BoB), but the company is not a government entity.

History of UTI AMC’s shareholding

Domestic Institutional Investors’ holdings have fallen from 61.17 percent (September 30, 2021) to 49.94 percent (June 30, 2022)

Foreign Institutional Investors’ holdings have increased from 28.95 percent (September 30, 2021) to 39.5 percent (June 30, 2022)

Read Also~Ukraine: History, Flag, Population | Tracking the war with Russia & Interesting Facts

Other investor holdings have increased from 9.88 (September 30, 2021) to 10.56. (June 30, 2022).

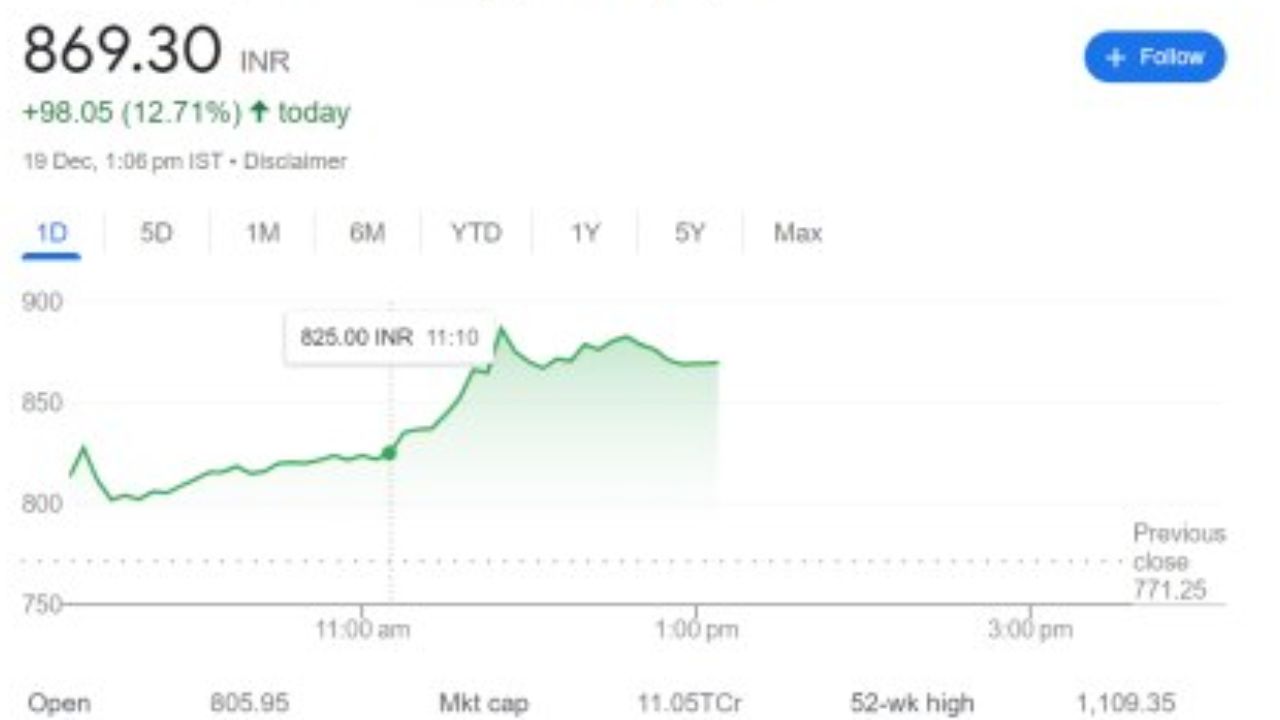

The market capitalization of UTI AMC shares is Rs 8,672.04 Cr. It ranks 22 in the Financial Services sector in terms of market capitalization.

AMC Stocks

UTI AMC is trading at 692.50 on 29 July 2022. Its IPO was launched on 29 September 2020 to October 1, 2020, with a price range from 552 INR to 554 INR.

The summer movie season has gotten off to a hot start for exhibitors, and more films are on the way. People are spending more money on concessions, and AMC is increasing its market share in its industry. Since 2019, the number of AMC shares outstanding has grown fivefold, and the stock is trading well above pre-pandemic levels.

The market cap is 87.92B INR, with a total float of 513 million shares. At #100, AMC’s market cap would be $51 trillion, nearly 25 times the value of the world’s largest companies today: Apple and Microsoft on the Big Tech side or Saudi Aramco on the oil side.

Read Also~Tamil Nadu State Marketing Corporation Limited-TASMAC History, Share Price & News Update

Three Reasons to Buy AMC Entertainment Stock and One Reason to Sell

- The summer movie season has gotten off to a hot start for exhibitors, and more films are on the way.

- People are spending more money on concessions, and AMC’s share is increasing its market share in its industry.

- Since 2019, the number of AMC shares outstanding has grown fivefold, and the stock is trading well above pre-pandemic levels. As a result, investors have reason to be concerned about dilution and valuation.