Territorial Tax: Territorial taxes are imposed on an individual’s designated local earnings when they temporarily stay in a territory. It does not cover non-resident taxpayers.

We shall explain the nuance in the very idea of local income. However, what matters most here is the way territorial tax can slash your total tax bill greatly like when you are a rich investor or business man.

Prior to creating your worldwide tax plan, it’s critical to comprehend the fundamentals of each tax type and its legal foundation, whether it be residency or citizenship:

Citizenship-based taxation: As the name suggests, you must file and pay taxes at home if you are a citizen of a nation that employs this tax system, regardless of where you reside or work in the world. The only way to stay away from this is to give up your citizenship. This system is only in use by the United States and Eritrea.

Residential Tax: This tax system, which is one of the most popular and simple to comprehend, stipulates that you must pay taxes in the country where you reside if you do not already. If a person resides in a country for more than 183 days, give or take, there is a foundation for taxation with a defined way to distinguish tax and non-tax residents. The majority of developed nations support taxing worldwide revenue but exempting foreign nationals.

Tax Schemes

One of four tax schemes is often implemented by nations worldwide:

- globally

- Territory-wide tax

- No taxes

- nations that are exempt from certain laws

Globally

In contrast to a territorial tax system, a global or worldwide tax system taxes an individual or business on all income generated, regardless of the location of the business.

Territorial Tax

Under territorial taxation, an individual or business is only subject to taxation on income received domestically and not on revenue from outside sources. Consequently, you do not pay taxes on any income you earn outside of the nation.

No Tax

Yes, you are correct—a very tiny number of nations allow you to live tax-free. In nations like the British Virgin Islands, the Bahamas, Vanuatu, Monaco, and the Cayman Islands, you, as a tax resident, will not be subject to income or capital gains tax.

Particular Dispensations

Of course, there are always exceptions, and a lot of countries currently have unique tax laws. These are frequently used to entice overseas investors. For instance, nations occasionally provide choices for lump sum tax payments, similar to those given in Italy, in an effort to draw in businesspeople, investors, and wealthy individuals.

How Are Territorial Taxes Calculated?

In a territorial tax system, only income earned domestically is subject to taxation. For example, your salary is taxed if you work and invest locally in real estate; however, your overseas company and investments are exempt from taxation.

Therefore, if you are a global earner—as many seven- and eight-figure investors and entrepreneurs do—you can successfully minimise, if not completely eliminate, your tax burden by relocating to a territorial tax country.

If you believed that the only way to reduce your taxes is to relocate to a nation like the UAE or Vanuatu that has a headline zero-percent tax rate, you would be mistaken. You can set up your tax affairs globally and pay little or no taxes in many other nations.

Only certain people will find zero-tax countries suitable for a variety of reasons. Sometimes tax haven countries are the greatest places to live full-time, whether it’s because they’re too expensive, too remote, or because there’s not much real economic activity there.

All things considered, relocating to a territorial tax country can save the majority of your income, provide you with a temporary residence, and allow you to continue taking advantage of travel advantages.

3 tax changes in the fiscal update: All You need to know

Paying No Tax by Utilising a Territorial Tax

If properly set up, there might be a means to pay as little as 0% tax on your international activities by:

There’s a widespread misperception that you may live and work in virtually any country, tax-free, as long as your money is earned elsewhere. That isn’t always the case. Certain nations impose comparatively high taxes on funds, such as salaries, that you remit to them if it is determined that they were earned there. Therefore, the source of income was local, or in that nation.

Since other nations have comparable laws, even though your job is being done through a foreign firm, you must make sure that it is not subject to income tax in that nation. It might not be.

Additionally, a lot of people believe it’s too difficult or easy to establish an offshore business and continue living where they are. Some people believe they must relocate to a tax-free nation if they wish to avoid paying taxes. That isn’t totally accurate.

They operate similarly to other nations in terms of domestic taxation; the only difference is that you won’t be required to pay in that country if your money comes from outside.Where to become a resident is a crucial decision for anyone hoping to gain from living abroad in terms of taxes and lifestyle.

You will therefore not be subject to tax on your worldwide income if you dwell in a territorial tax jurisdiction long enough to qualify as a tax resident. It’s best to maintain your primary banking outside of the country because other nations have regulations on sending money back home.

This enables you to select locations as part of an investment plan, as well as places to live, work, hire, and incorporate in order to maximise your tax benefits by moving to an area where you would receive the greatest treatment.

You may count on the territorial tax nation to provide you with major advantages when organising your affairs.

- Operating a zero-percent location for your business.

- Resideting in a country where there is no foreign income tax.

- Having real estate in an area with low taxes.

- You are opening bank accounts in jurisdictions that do not impose taxes on interest.

- You are purchasing your stocks in a non-taxing nation.

- You can make significant financial savings if you arrange those things correctly.

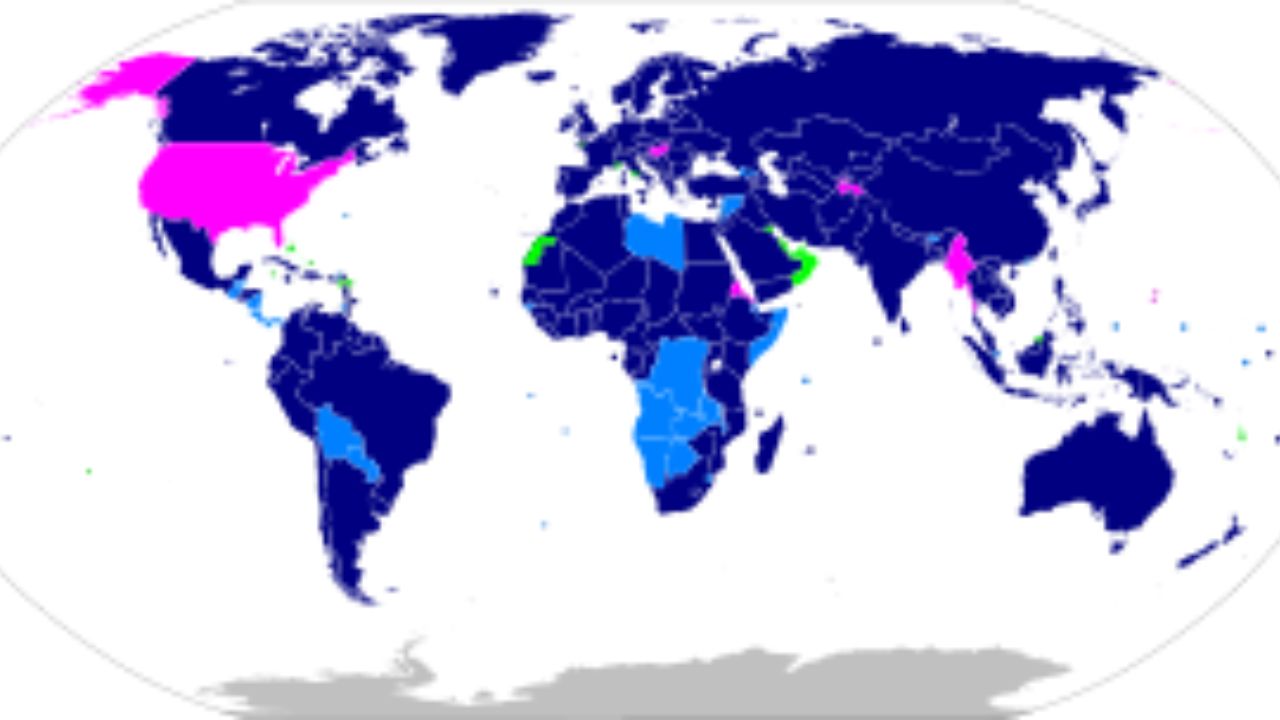

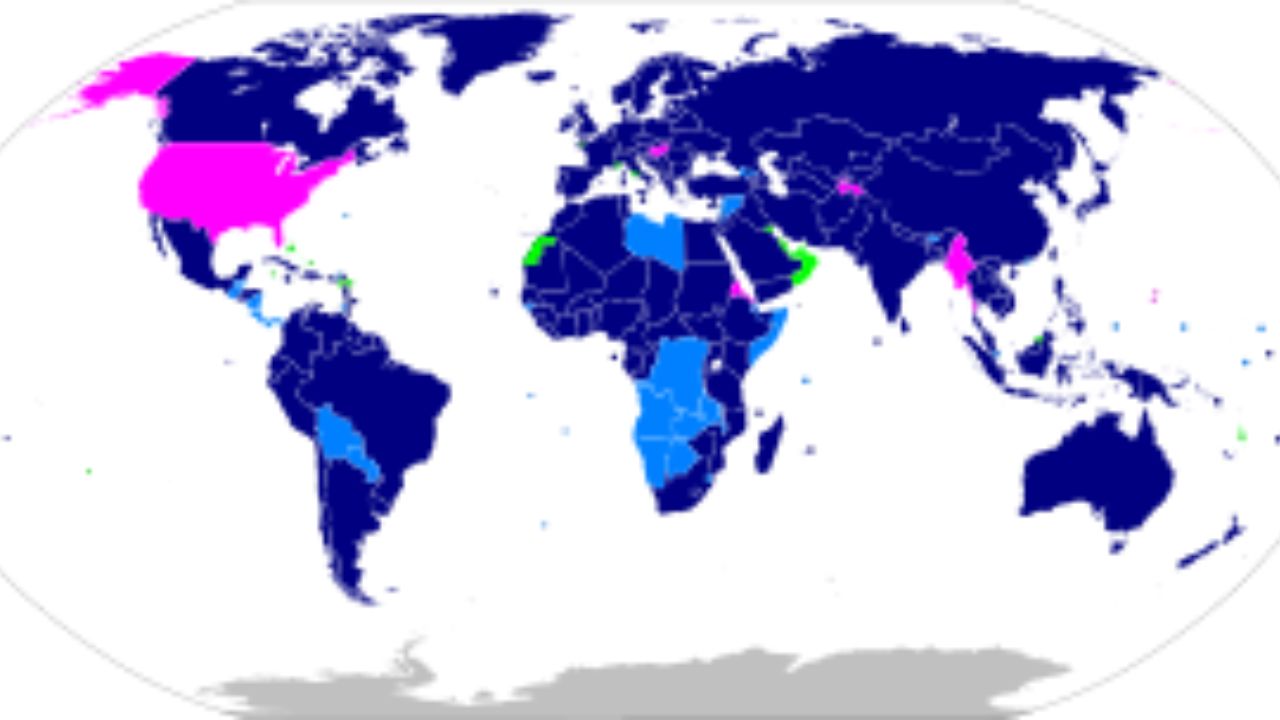

Countries with Territorial Taxes

Countries in Asia including Malaysia, Singapore, Thailand, the Philippines, Georgia in Eastern Europe, and Central America’s Panama, Nicaragua, and Costa Rica are a few examples of suggested territorial tax nations.

These are just a few instances when, if you become a tax resident, your overseas income from real estate and foreign firms is not subject to taxation. Check out our ranking of the Top 10 Territorial Tax-Paying Countries if it piques your interest.

It’s not always free from constraints, even though it’s territorial; if you have a work visa, it may be considered a local source in some circumstances. It can occasionally become a balancing act to determine how much of your firm’s revenue is generated by you because you’re considered to be making money within the nation; for instance, your salary may be subject to taxes but the company may not. Numerous distinct regulations are applicable.

Territory-specific Exemptions from Taxation

Territorial tax systems in place in some countries specify what is and isn’t taxable. On income received within a territorial tax country, taxes are due. Working for an offshore company while residing in a territorial tax nation can become more challenging, though.

Let’s say you are a resident of a territorial tax country, but theoretically your employer pays you from a bank account in another country because it is based there. If so, you aren’t receiving it in the territory where you pay taxes.

This may give you the impression that you are not subject to taxes, but since you are employed and reside in that nation, you may have to pay taxes because you were present when the money was earned.Assuming you are taxed where your consumers are—which is typically different—is a common mistake. Generally speaking, you are not taxed where your clients are. You are normally taxed in the location where your firm resides, as well as where the work or permanent establishments are, albeit this does depend on the type of income and the type of business.

Therefore, if your business is located in a territory that levies taxes, such as Panama or Costa Rica, and you sell to customers in Europe, you will be subject to taxes. Although there may be exceptions, you will probably be subject to taxes in Costa Rica if you are performing the work there. Dividends are frequently exempt from taxation. Although there are certain exceptions, such as Singapore, sending money from overseas usually avoids taxes. However, it varies according on the source of the territoriality.

The definition of foreign income can be fairly complex; pensions, various forms of investment income, customer locations, and employment locations are just a few examples where specifics must be considered. The trouble about foreign tax is that specifics matter.

Relocating to a Territorial Tax Nation

Living abroad can save taxes in a number of ways, such as by maintaining houses abroad or roaming as a nomad. However, if you’ve already amassed fortune, you might want to refrain from feeling compelled to relocate frequently. So tell me, how can you dwell in one location and save money on taxes?

The most popular choice is to just relocate to a nation with no taxes. Now, if you’re from the United States, where taxes are paid everywhere you go, you’ll need to make further arrangements to reduce your domestic taxes. Thus, you could go to Monaco, Dubai, or Vanuatu, for instance, set a shop, register as a resident, and avoid paying taxes.

As we’ve talked about, not everyone can choose that option. Do you know of any other way to accomplish this?

Depending on your tax budget, that is. Although paying no tax seems appealing, if your current tax rate is 50%, you could be ready to pay 10% in order to maintain your current standard of living. Sometimes it makes more sense to think about paying for what something has to provide.

You can travel to territorial tax countries like Malaysia, Singapore, Costa Rica, Panama, and others to accomplish so, and there is no tax on income derived from outside the country. There will be regulations in many of these nations regarding bringing money into the nation to support oneself; this money may be subject to taxes, or you may be required to pay taxes on your wages while you are there. These nations have modest taxation, but it’s based on a far smaller percentage of your income, and if you’re careful with how you send money, you might not pay any taxes at all.

Everybody’s circumstances require careful planning with regard to how they operate their business, send money home, and live. It is feasible to reside in one location full-time, skip tiny little islands and hot desert countries, and significantly lower your tax cost in dozens of other countries—many of which require analysis of many aspects.