Silver Price History: Historical Silver Prices Data in India

Silver reflects the prices of the most reflective metal. From the trading of silver to investment in silver and trends in silver prices.

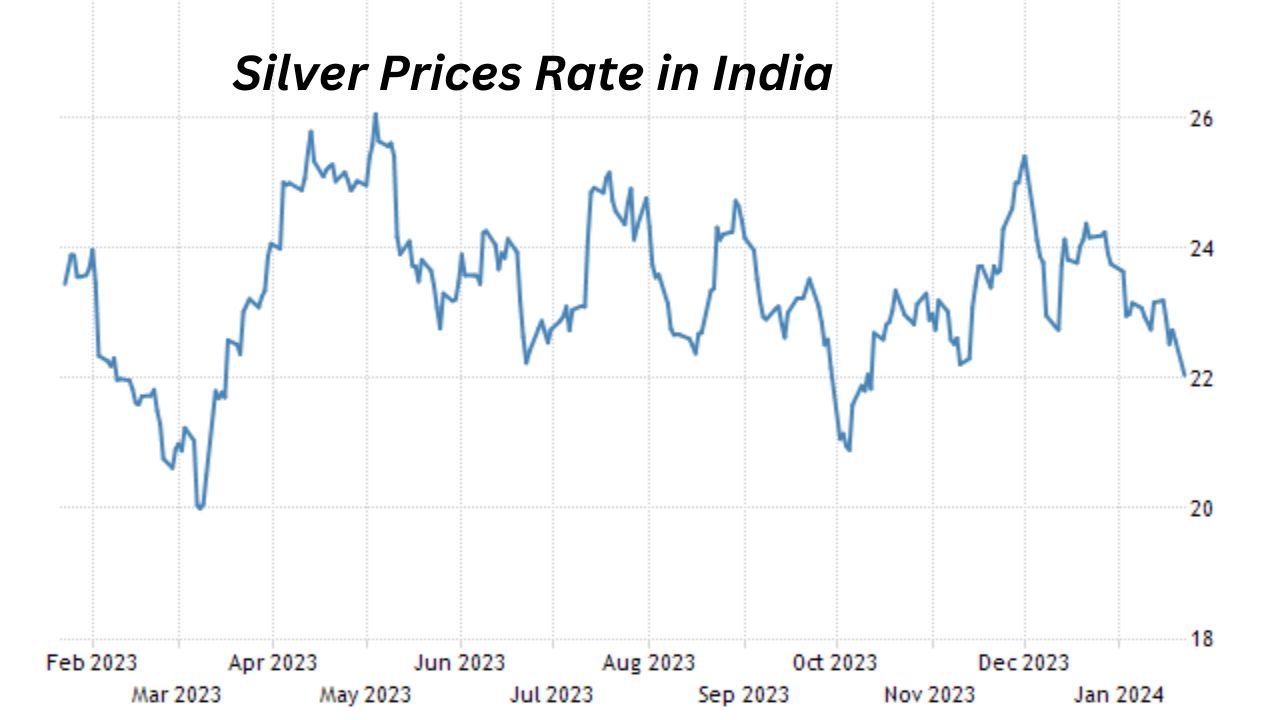

Trends in Silver Prices: Trends in silver prices are hard to predict as they depend on various factors. It is the amount a buyer has to pay to purchase a single ounce of silver. Internationally, silver is sold in ounces priced using dollars, and the trading takes place 24*7 resulting in live silver prices.

These are some of the websites that provide updates live updates on silver prices.

https://www.kitco.com

https://www.bullionvault.com

https://www.metalsdaily.com

What affects silver prices?

Supply and demand of the metal: Silver prices shoot up when the supplies are low. Similarly, its prices drop when supplies increase due to scraping, melting & stockpiling of the metal.

Inflation: During inflation, the purchasing power of paper money erodes steadily, so people rush to convert their cash into valuable metals like gold and silver due to their intrinsic value.

Read Also~Hindustan Zinc Ltd: Check HZL Share/Stock Price, News & Updates

Strength of the dollar: Similar things happen when the dollar weakens, people turn towards more reliable sources of wealth like gold and silver.

Gold-silver ratio/mint ratio: This ratio states the ounces of silver needed to purchase a single ounce of gold. The Thai rate allows investors to make a relatively safe bet on both metals. When the ratio is high, it is an excellent time to buy silver; when the ratio drops low, it sends a clear signal to purchase gold.

Major consumers of silver

The first known human discovery of silver was around 5000 years ago in Anatolia (modern Turkey). Since then, silver has played various roles in human activities.

Its strength, malleability, thermal & electric conductivity, the reflectance of light, and low reactivity(as a noble metal ) have made its use possible both as precious metal & raw material in the industry.

Data from 2010 reveals that most silver is used for: Industry (487.4 million ounces), jewelry (167.0 million ounces), and investments (101.3 million ounces).

Trends in Silver Prices

Silver has a somewhat volatile & fluctuating market as compared to gold.

The reason is that the demand for silver keeps fluctuating between its dual role as an industrial raw material and a precious metal used in jewelry.

So actual trends are difficult to predict as they depend on many variables accurately.

Trading & Investment in Silver

Silver is a rare & precious metal that allows trading in various forms.

New York, London & Hong Kong are prime centers for silver commodity trading, while the COMEX division of the New York Mercantile Exchange is involved in the paper trading of silver.

Silver bars: It is the traditional way of hoarding silver through trading bullion bars.

Read Also~Copper: Sources, Profile, Usage & Others Interesting Facts

Exchange-traded products( ETPs):

- Silver ETPs allow one to invest in silver without actually buying bullion bars.

- Ishares, ETF securities, and Sprott physical silver trust top the significant options available

- Accounts

- Most Swiss banks offer silver accounts that we can trade like foreign currency.

- Silver coins

- Canadian Silver Maple Leaf (99.99% silver) & American Silver Eagle (99.93% silver) an examples of contemporary silver coins.

Mining companies: It includes owning shares in mining companies that mine various precious metals. Investing in mining mutual funds also adds to the options available.

An element that shines like its price, there’s no doubt that silver prices and silver investments always manage to stay the market’s hype throughout the year!