Marico Limited- Share/Stock Price, News & Updates

Marico is a company that produces goods and services that are in high demand. The share price of Marico Share is Rs 546.40 as of 28 Sept 2022.

Introduction of Marico

Marico Share prices are highly sensitive to global economic conditions and are therefore likely to be affected by any changes in the global economy. In the short term, this could mean a decline in the share prices, while in the long term, it could mean a rise in the share prices.

Given the current market conditions, it is important to analyze the potential risks that Marico Share prices might face in the future. In the short term, the company is likely to experience weaker demand from the retail sector, which is already facing pressure from online shopping.

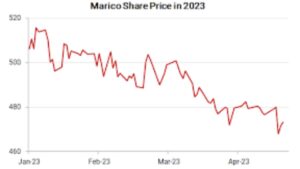

Overall, the downward trend in Marico Share prices could continue in the future, unless the company manages to restore its profitability in the consumer goods sector.

Read Also~ HDIL: A Real Estate Company – Overview, History & Share/Stock Price

History of Marico

Marico Share prices are currently in a downward trend. This could continue in the future, as the company reports weaker than expected earnings for the quarter ended 31st March.

The main reason for the drop in share prices is the weak performance of the company’s consumer goods segment. Marico’s core products – apparel and food – have been struggling in the current global market.

Current Events of Marico

A key risk for Marico Share prices is the global economic slowdown. Weak global economic conditions may lead to a decrease in consumer spending, which could in turn impact Marico’s profitability. In addition, a slowdown in the Chinese economy could also hurt Marico’s Share prices.

Another key risk for Marico Share prices is the performance of the Marico Share price index. The Marico Share price index is a measure of the performance of the Marico Share price over a chosen period. The index is composed of the weighted average prices of the Marico Share prices of the last 50 trading days.

If the Marico Share price index falls below a certain level, this could indicate that investors are losing confidence in the company’s future performance and may sell their shares. This could hurt Marico’s Share prices.

Read Also~ Havells India Limited: History, Products – Stock Share Price NSE/BSE

Although the company has been trying to diversify its business, it still relies too much on its consumer goods segment. This could lead to a future slowdown in this sector, which would then hurt Marico’s Share prices.

Fall of Marico Share

The first reason for the fall in share prices is the weak performance of the company’s main businesses. Marico’s core businesses are textile, FMCG, and footwear. These businesses have been struggling in the past few years and this has hurt the share prices.

The second reason for the fall in share prices is the uncertainty surrounding the company’s debt situation. Marico has been struggling to service its debt and this has led to speculation that the company might be forced to sell off some of its assets.

This uncertainty has hurt the share prices. Investors should be aware of these factors and adjust their investment decisions accordingly.