Insurance Sector: A Brief Overview, History & News Update

Companies in the insurance sector provide risk mitigation through insurance service agreements.

Insurance Sector: Companies in the insurance sector provide risk mitigation through insurance service agreements. The basic idea behind insurance is that one participant, the insurer, will guarantee payment for a potentially disastrous future event. Meanwhile, another party, the insured or policyholder, pays a lower premium to the insurer in exchange for that safeguard against an unknown future event.

About Insurance Sector

The insurance industry is composed of various types of players who operate in various areas.

Life insurers are concerned with legacy planning and replacing human capital value. In contrast, health insurers protect medical costs and property, personal injury, or accident insurance is concerned with replacing the valuation of homes, cars, or valuables.

Insurance companies can be organized as either traditional stock companies with outside investors or mutual companies with policyholders as owners.

Insurance is recognized as a slow-growing, safe industry for investors. This perception is not as powerful as it was in the 1970s and 1980s, but it remains widespread compared to other financial sectors.

Categories of the Indian Insurance Sector

The Indian insurance industry is divided into life insurance and non-life insurance. Non-life insurance is also known as general insurance. The IRDAI regulates both life insurance and non-life insurance.

The IRDA’s role is to monitor India’s entire insurance sector thoroughly and act as the custodian of all insurance consumer rights. This is why all insurers are required to follow the IRDAI’s rules and regulations.

India’s insurance industry is made up of 57 insurance companies. There are 24 life insurance companies, and the rest 33 are non-life insurance companies. There are seven public sector organizations among them.

Life insurance companies provide coverage for people’s lives. In contrast, non-life insurance companies provide coverage for our daily lives, such as travel, health insurance, car and bike insurance, and home insurance. Not only that, but non-life insurance companies also cover our industrial equipment. Crop insurance for farmers, mobile phone insurance, pet insurance, and other insurance products are being made available by general insurance companies in India.

In recent years, life insurance companies have developed an investment prospectus to provide insurance while growing your savings. However, general insurance companies are still hesitant to provide individuals with pure-risk coverage.

The Insurance Sector’s History in India

LIC was the only life insurance provider in the Indian insurance sector a decade ago. Other public sector companies in India, such as National Insurance, United India Insurance, Oriental Insurance, and New India Assurance, offered non-life insurance, also known as general insurance.

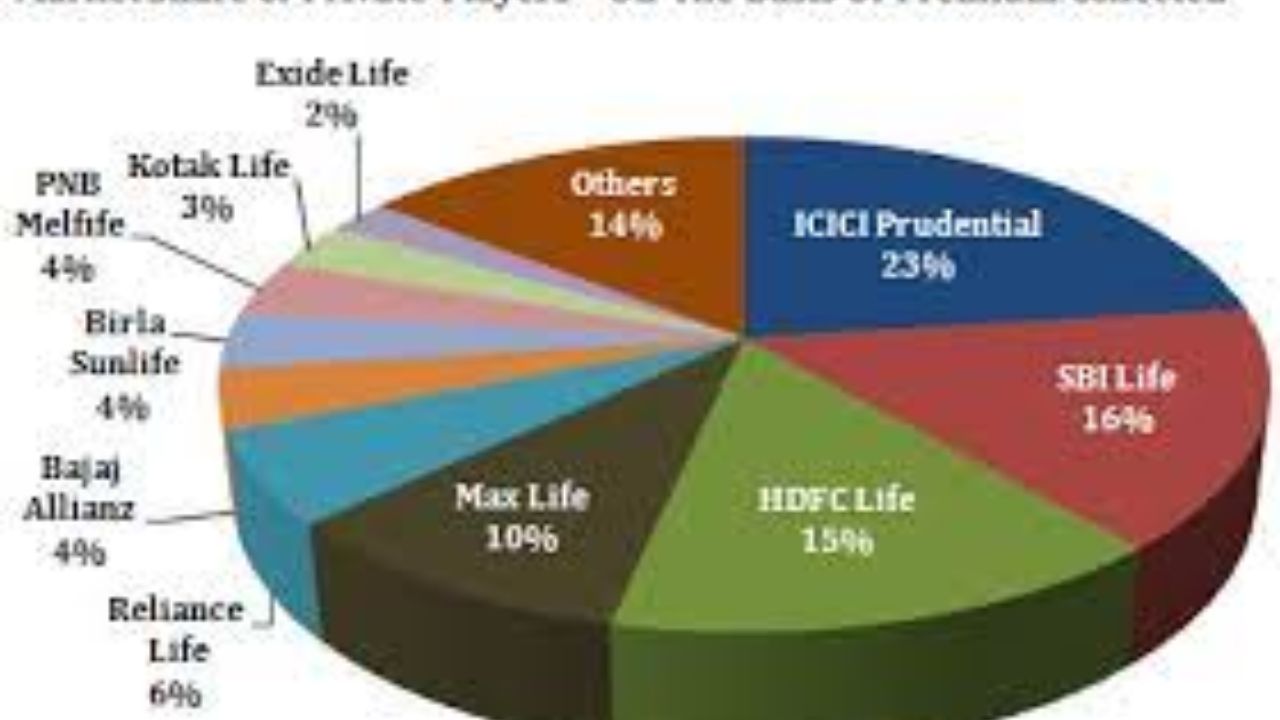

Moreover, with the emergence of new private sector companies in the year 2000, the insurance sector in India gained traction. 24 life insurance companies and 30 non-life insurance companies are aggressive enough to dominate the Indian insurance sector.

However, many more insurers are awaiting IRDAI approval to begin operations in India’s life and non-life insurance sectors.