WeShop Delivers First Share Buybacks to Shoppers, Postpones IPO Launch

WeShop Delivers First Share Buybacks: WeShop gave 20% of every buy price as investment shares so that it could be cashed out after a year. The company plans to compete with Amazon by listing its shares.

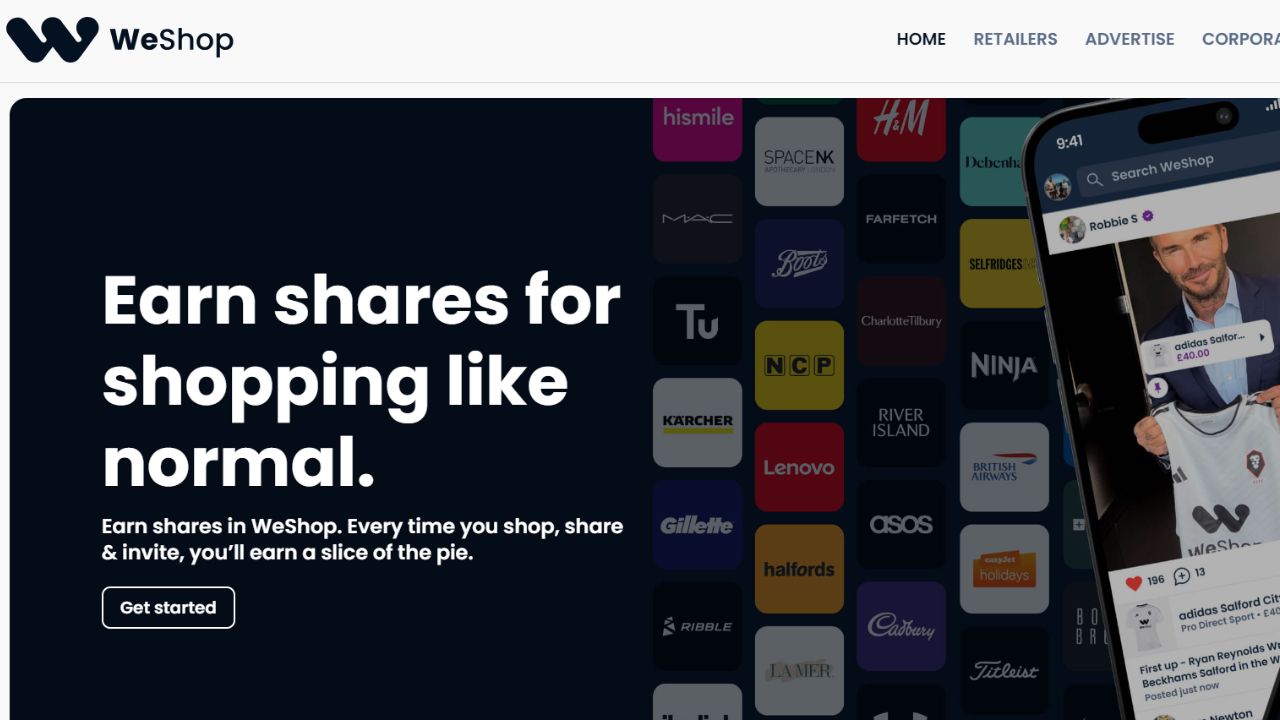

WeShop Delivers First Share Buybacks: The search and discovery e-commerce platform WeShop has given out its first share buybacks, which led one shopper to earn £9,000.

Due to instability in the stock market, the company is delaying the launch of its IPO, as per the UK tech firm.

The world’s first customer-owned shoppable social network is delaying its public offering to the end of this year. Earlier, it planned to go public in July.

The company’s chairman Richard Griffiths had a talk with the PA news agency stating the reason behind the delay, Richard told PA that it the because of the inconsistency in the market which was caused by the failure of US lender Silicon Valley Bank in March.

Also Read: Saudi and UAE Dominate MENA IPO Market with $2.6 Billion Raised Across 14 Sales

It may reconsider its decision to choose the Nasdaq tech-heavy index in New York to go public. This comes after the changes in the American IT sector, which caused companies like Google, Amazon, Microsoft, and Facebook to lay off tens of thousands of their employees.

This means the company might go to the London market instead. But Mr. Griffiths said the Nasdaq is still the company’s first choice, and he is working on a test start of the platform in the US during the third quarter, before the expected IPO.

While speaking about the IPO plans, Griffiths said, “We’re aiming for the end of the year, but having to be fluid, particularly because of market conditions. The technology sector is very difficult and the Nasdaq is not performing as well as it has done.”

Also Read: Hero Motors, Backed by South Asia Growth Invest, Files for ₹900 Crore IPO

The company said it would look at its plans if it turns out to be “not the right moment.” WeShop still wants to go public in 2023.

He insisted that WeShop would still buy back shoppers’ shares regardless of the plans for the listing. The first payments had already been made.

The company has made about a dozen shoppers’ shares who were involved in the trial before its official launch in July last year. The lowest payout was £250, and the highest was £9,000 with purchases on the site and referrals.

WeShop gave 20% of every buy price as investment shares so that it could be cashed out after a year. The company plans to compete with Amazon by listing its shares.

The company includes Alex Chesterman, founder and boss of Cazoo, Andrew Black, co-founder of Betfair, and Nigel Mansell, former Formula One driver, and his son Leo.

The company also has over 115,000 used and more than 14 million purchase of goods have been executed through this platform. \

Also Read: Carraro India all set to launch its first IPO, files IPO papers with SEBI