Singapore Car Startup Aims for $1.5 Billion Valuation Ahead of IPO

Singapore Car Startup: As per the reports, around 4,500 workers are currently working in the company and its investors include SoftBank Group Corp, Singapore’s GIC Pte and Temasek Holdings Pte.

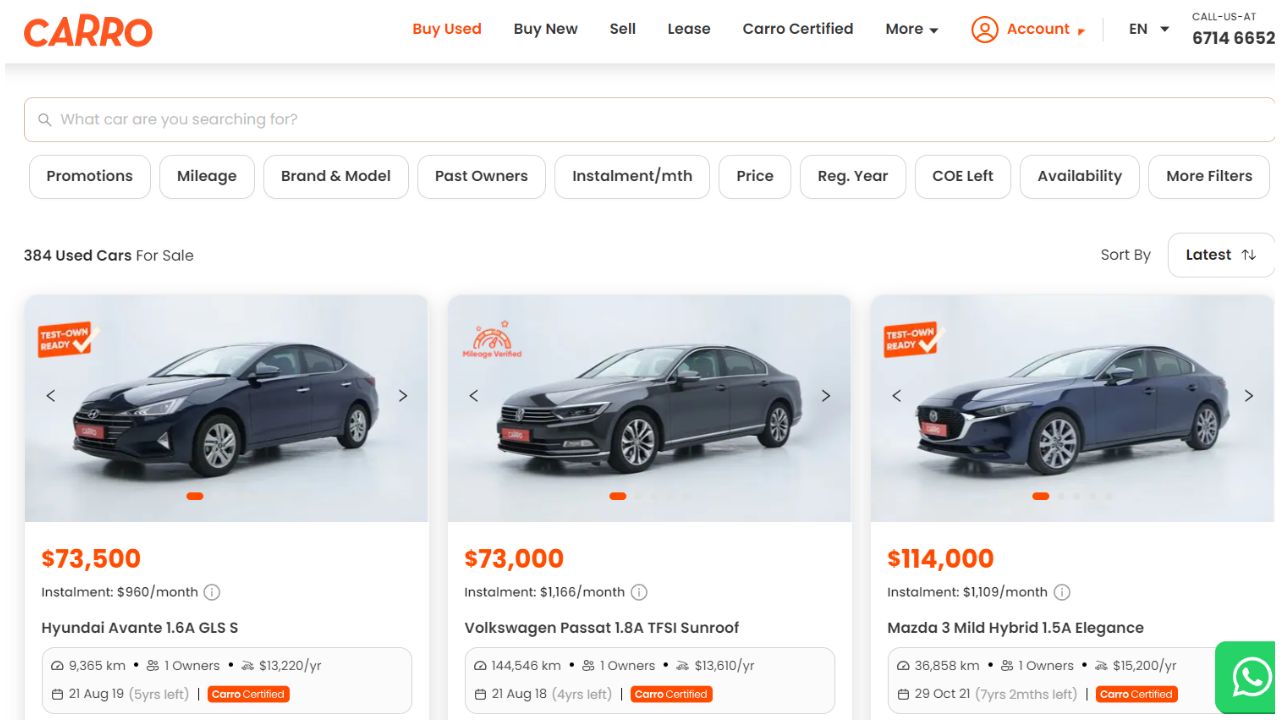

Singapore Car Startup: Carro, a used-car platform in Southeast Asia plans to raise about $100 million as it is all set to launch on the stock market.

The used car company reported that the funds gained from the stock market debut will help the company to stand out among its competitors.

In an interview, Chief Executive Officer Aaron Tan reported that the company is speaking with its investors about a pre-IPO funding round to raise funds more than $1.5 billion.

As per the reports, around 4,500 workers are currently working in the company and its investors include SoftBank Group Corp, Singapore’s GIC Pte and Temasek Holdings Pte.

The company recently shared its first annual operating profit.

Also Read: Honasa Consumer: Mamaearth Stock Surges 45% Since IPO—What’s Next?

Carro provides services that allow customers and dealers to buy and sell used cars. The company is trying to get back its investors who were scared off because of a drop in startup valuations in the past two years.

Carro’s CEO showed a tool called the “Shazam of engines” as it can tell the condition of a second-hand car from the sound of the engine and the company also has a return policy within five days.

The company also plans to expand its business operations this year in Japan and Hong Kong.

Tan added, “We are ready for an IPO. Whether or not we list depends on the broader macro environment.”\

Also Read: Saudi and UAE Dominate MENA IPO Market with $2.6 Billion Raised Across 14 Sales

CEO resignations, and falling startup values in Southeast Asia’s tech industry, which made it hard for companies to go public.

At the same time, the prices of used cars are going down, which makes it harder to sell cars for a profit. Furthermore, the prices of car loans are increasing because of inflation and a hike in interest rates.

Tan further said, “It’s easy to do this at a mom-and-pop shop level. But if you want to do this at scale, you need investments, you need a lot of space, you need the manpower and of course the tech and systems.”

Insignia’s Tan at last added, “It is important that Carro wins a few more markets in Asia Pacific, as the institutional investors in USA will find these APAC markets such as Japan and Hong Kong more sexy. Technology without discipline can lead to an early head start but also an early crash.”

Also Read: IPOs and Dividends Attract Yield-Hungry Investors in GCC